Parler

Parler Gab

Gab

Where have all the foreigners gone?

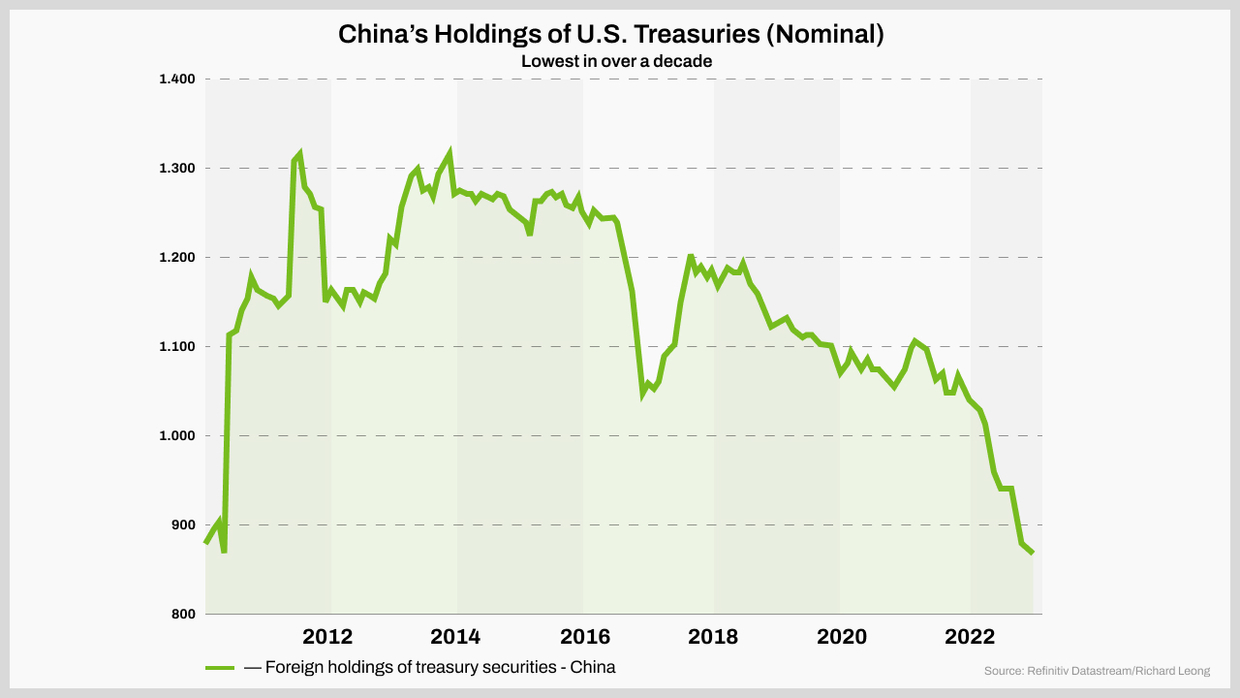

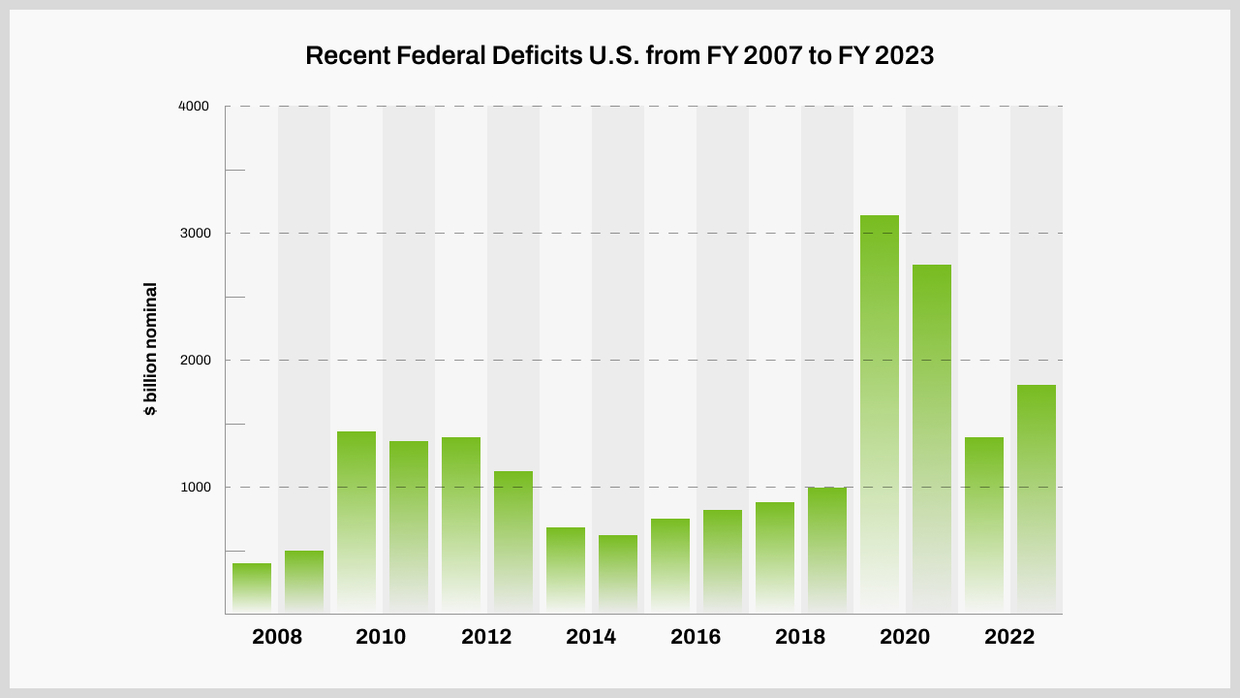

There was a time when Treasuries were essentially the US’ biggest export and served as the mechanism for the sort of macro-level vendor financing scheme under which the US imported goods and energy from the rest of the world in exchange for dollars – and these dollars were dutifully recycled back into Treasuries to finance the US deficit. When deficits began to surge in the 1980s under President Ronald Reagan, many wondered how they would be financed. But starting in the middle of that decade, foreign central banks – primarily the Japanese – swooped in and started scooping up larger amounts of US Treasuries. Over 1986-2002, foreign central banks bought 28-30% of all aggregate US Treasury bonds issued; from 2002-2014, the People’s Bank of China (PBOC) had become the main buyer and the foreign purchases figure reached a whopping 53%. Since 2014, that figure has been negative 4%, meaning foreign central banks have stopped buying on a net basis, all while US deficits have continued to grow. There are many reasons for that shift. A lot of attention has been given to the first batch of sanctions on Russia in 2014 and Moscow’s subsequently embarking on the path of dollar divestment – a process that Beijing was watching closely. But there was also a deeper realization across the globe that the US no longer would or could manage the dollar in the best interest of the world. When the Fed unleashed its unprecedented quantitative easing program in March 2009, Chair Ben Bernanke admitted that it had “crossed the Rubicon.” Five days after the program was announced, Zhou Xiaochuan, the governor of the PBoC, released a white paper with the not very subtle title ‘Reform the International Monetary System’ calling for a remaking of the post-World War II framework. By 2014, having watched the Fed quadruple its balance sheet to some $4.5 trillion, China made the strategic decision to stop adding to its Treasury portfolio. The cavalier nature in which the Americans were printing money for purely domestic reasons – thus implicitly devaluing the existing debt of which China held a lot – surely did not sit well in Beijing.

The first inkling of a liquidity problem

Incidentally, it was also 2014 when problems with Treasury market liquidity first began to draw scrutiny. In October of that year, the market convulsed with no apparent trigger in what ended up being dismissed as merely a “flash rally.” There have been several other significant convulsions along the way – the sudden repo crisis in September 2019, the Treasury market seizing up in March 2022, and the UK Gilt market breaking in the fall of 2022, which reverberated in the Treasury market, but we’ll fast-forward to 2022. The nastiest bout of inflation in four decades had forced the Fed to sharply hike rates. The higher interest rates pushed bond yields up, and since bond prices move inversely with yields, US Treasuries took losses. Many US banks became deeply underwater on their Treasury positions, a fact that played no small role in the collapse of Silicon Valley Bank earlier this year. There were many specific reasons why that particular bank collapsed – practically non-existent risk management being one of them – but what that episode revealed is that many banks were sitting on large unrealized losses in their Treasury positions. As depositors demanded their money back – both for fear of bank failures and in order to place their money in higher-yielding money market funds – banks would have had to sell their underwater Treasuries into a rapidly deteriorating market, where bids would have been few. However, undoubtedly sensing the fragility of the entire system and not wanting a full-blown meltdown on their watch, Fed Chair Jerome Powell and colleagues decided to act – and they acted decisively.Rolling out another acronym

But what exactly did they do? They instituted another one of those acronym bailout programs, this one called the Bank Term Funding Program (BTFP). At a time when the Fed was attempting to tighten financial conditions to fight inflation, this had the effect of adding liquidity to the market, thus proving (as if there had been any doubt) that the Fed’s macho rhetoric about fighting inflation extends only to the point where market dysfunction begins. The BTFP allowed banks to access one-year loans from the Fed by posting bonds. There’s nothing unusual about that – pretty standard stuff. But it’s the pricing that raises eyebrows. Instead of following normal practice and forcing those bonds to be marked to market – meaning using the market value rather than the nominal value – the collateral can be posted at par, regardless of where it is trading. So a bond that, say, has a nominal value of $100 but is currently trading at $70 can be posted to the Fed in exchange for a $100 loan. But the story is actually a lot more interesting than that. As analyst Luke Gromen pointed out, when you peer below the surface at the BTFP facility, you realize that it is basically tantamount to soft yield curve control for banks – at least for those with US branches. In other words, it was as much of a bailout of the Treasury market as a bailout of the banks. It certainly was a bailout for banks, which were quickly being wrongfooted by a double-whammy of market moves against them and deposit outflows, and needed to cover their substantial paper losses. But the deeper implication was that this served as something of a foreshadowing of yield curve control – an unorthodox policy tool employed by central banks to target with purchases a specific interest rate level. One thing should be made explicit: yield curve control is where free financial markets go to die. Although the Fed wasn’t targeting a specific interest rate but was rather seeking to control the flow of credit, the policy tool had the effect of essentially capping yields below the current market price – and that is an important harbinger of where things are headed. The collapse of Silicon Valley Bank is now old news and the powers that be have provided assurances that the banking crisis is long over. But the BTFP figures seem to say otherwise: as of June 28 (the most recent data I could find), the takeup of the program by banks had reached over $100 billion – meaning that the bailouts have still been happening many months later. The BTFP is supposed to run for just one year, but there is already talk that it will become a permanent part of the financial landscape. As the old saying goes, there is nothing more permanent than a temporary government program.

The Treasury announces buybacks….wait buybacks?

Meanwhile, more recently another firm step in the direction of yield curve control was taken when the US Treasury announced that it would be launching a buyback program next year. Somewhere along the way in the slow descent of the US Treasury market into illiquidity and dysfunction we were bound to see direct Treasury purchases of debt that nobody in the market wants to buy – and now we have it. This tool hasn’t been trotted out since the year 2000, when it was done under very different circumstances (the government was running a surplus and was issuing Treasuries to maintain market access, with the proceeds from the new bonds used to repurchase the old ones). Now, however, this is being done, according to comments by one Treasury Department official at a forum in New York in September to “[help] to make the Treasury market more liquid and resilient” and in a bit of cheery party-line speak, “to ensure that the Treasury market remains the deepest and most liquid market in the world.” Statements such as these made in a casual business-as-usual way and presented as a small maintenance program that will not be used to combat a potential crisis belie just how much this represents another “crossing of the Rubicon.” If you unpack this, it means that the Treasury is preparing for the possibility that there won’t be enough buyers for the avalanche of issuance that will be hitting the market in the coming quarters. By announcing a buyback program, the Treasury is essentially laying the groundwork to become the ‘buyer of last resort’ without stating so explicitly, which would of course spook the markets. It is also pretty much exactly what Japan has been doing for the last decade or so – essentially nationalizing the debt that nobody wants. Legendary analyst Zoltan Pozsar has described what we’re seeing as the Fed and Treasury “building scaffolding around the Treasury market” to deal with issues of illiquidity and the lack of a marginal buyer. The question that can’t be asked but needs to be asked is: why is all this necessary in the deepest, safest and most liquid market in the world?The government is spending like there’s no tomorrow

Meanwhile, this year the US deficit is expected to hit $2 trillion, representing an astounding 8.5% of GDP and there is no sign that it is slowing down. This is a practically unheard of figure during a time of economic growth. Unsurprisingly, Treasury issuance is slated to go through the roof in the coming quarters. In addition to the separate question of how the US can afford the suddenly massively higher interest payments on this debt – now estimated to reach $1 trillion on an annualized basis this year – there is the issue of the acute lack of marginal buyers of this debt.

Israel-Hamas war will continue until rights are recognized – analyst

By News Editors // Share

RFK Jr. launches petition demanding Biden release JFK assassination documents

By News Editors // Share

Russian lawmaker wants BRICS to CREATE ITS OWN INTERNET free of Western influence

By Arsenio Toledo // Share

A shocking new survey reveals the greatest threats that preppers in the U.S. believe we are facing

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share