Parler

Parler Gab

Gab

Timeline of Supply Chain Disruptions in the USA

Immediate (Next 1–2 Weeks) (mid-May)

- Sharp Drop in Import Volume:

- A 30% decline in incoming shipments (≈50,000 fewer containers) begins hitting U.S. ports, exacerbating existing backlogs.

- Delays in unloading due to manpower shortages at docks and trucking networks worsen.

- Retailer Reactions:

- CEOs freeze imports, hiring, and capital investments due to uncertainty.

- Retailers warn of price hikes (10% or more) to offset rising costs.

3–4 Weeks Out (early June)

- Visible Shelf Shortages:

- Chinese-made goods (≈80% of Walmart-like inventories) begin running out as pre-existing shipments are depleted.

- Spot shortages emerge for high-demand items (e.g., electronics, seasonal goods like spring/summer fashion).

- Transportation Slowdown:

- Truckers see reduced loads (4–5 containers → 2–3), cutting into wages.

- Dock workers lose overtime, shifting to below-standard workweeks, further slowing operations.

5–7 Weeks Out (mid to late June, extending into July)

- Critical Inventory Depletion:

- Retailers exhaust 5–7 weeks of "normal" stockpiles; empty shelves become widespread.

- Back-to-school items (a political flashpoint) face shortages if no resolution is reached.

- Economic Spillover:

- Inflation spikes as scarcity drives up prices.

- Unemployment rises in logistics (trucking, warehousing) due to reduced trade volume.

If a Trade Deal is Reached (Optimistic Scenario)

- 1-Month Lag to Recovery:

- 2 weeks to reposition ships from Chinese ports (Qingdao, Shanghai) and reload containers.

- 2 weeks for transit across the Pacific.

- Total: Shelves begin refilling after 4+ weeks, but seasonal demand (e.g., summer fashion) may already be missed.

If No Deal (Worst-Case Scenario, projections based on the transcript)

- Ocean Freight Collapse:

- Shipments from China could drop 100%, paralyzing global trade.

- "Desperate" Conditions:

- Empty shelves, rampant theft, and social unrest in urban areas.

- Long-Term Damage:

- Inflation spirals, businesses halt expansion, and unemployment spreads beyond logistics.

Key Takeaways

- Speed Matters: A Trump / China trade deal within weeks is critical to avoid irreversible consumer and economic harm.

- Global Domino Effect: Disruptions would quickly extend beyond China (Mexico, Canada, Southeast Asia).

- Political Pressure: Back-to-school shortages could force government intervention to avert a full-blown crisis.

Economic Impacts for Typical American Workers and Consumers

I also asked our Brighteon AI engine (Brighteon.AI) to describe what life will be life in America if no deal is reached for four months. In other words, I wanted Enoch to extend the projection scenario described by Mr. Seroka. You can decide for yourself whether you think Enoch is correct (or I suppose we'll all find out soon enough if no trade deal is reached). Here is what Enoch projected:5–7 Weeks Out (Mid-to-Late June, Extending into July) Emerging Crisis

- Widespread Empty Shelves:

- Retailers exhaust backup stockpiles—no new shipments arrive from China.

- Back-to-school items (laptops, backpacks, shoes) vanish, causing parental panic.

- Auto parts shortages halt car repairs—dealerships run out of key components.

- Economic & Social Fallout:

- Inflation skyrockets (20–30%+ on remaining goods) due to scarcity.

- Unemployment rises in logistics (trucking, warehousing, retail).

- Small businesses reliant on Chinese goods (restaurants, repair shops) begin closing.

8–12 Weeks Out (August) – Societal Breakdown Begins

- Black Markets & Theft Surge:

- Looting increases in urban areas as desperation grows.

- Underground resale markets for electronics, medicine, and tools emerge.

- Manufacturing Shutdowns:

- U.S. factories (cars, appliances, medical devices) halt production due to missing Chinese parts.

- Tech companies (Apple, Dell, HP) delay product launches indefinitely.

- Housing Market Collapse:

- Construction stalls—no Chinese-made materials (steel, wiring, PVC pipes).

- Home prices drop as buyers fear long-term instability.

13–16 Weeks Out (September) – Desperation Sets In

- Food & Medicine Shortages:

- Pharmaceuticals (antibiotics, vitamins, generics) run low—China supplies 80% of U.S. drug ingredients.

- Grocery stores ration canned goods, rice, and frozen foods (many rely on Chinese packaging).

- Currency & Financial Crisis:

- Dollar loses value as imports vanish—hyperinflation looms.

- Stock market crashes as corporate earnings collapse.

- Civil Unrest & Government Response:

- Riots erupt in major cities over food and supply shortages.

- Military may be deployed to secure ports and distribution centers.

- Government rations essential goods (fuel, medicine, food).

Long-Term Consequences (If No Deal is Reached Beyond 16 Weeks)

- Permanent Economic Damage:

- Millions unemployed as factories, retail, and logistics collapse.

- U.S. forced to rebuild supply chains from scratch—a process taking years.

- Global Ripple Effects:

- Mexico, Canada, and Europe suffer from U.S. economic crash.

- China’s economy also collapses from lost exports, leading to global recession.

Conclusion: A Nightmare Scenario

If no trade deal is reached within four months, America would face: ✔ Many empty shelves in 80% of stores. ✔ Accelerated inflation (prices doubling or tripling). ✔ Mass unemployment (logistics, retail, manufacturing). ✔ Black markets, looting, and civil unrest. ✔ A near-total breakdown of consumer society. The only way to avoid this would be a rapid trade deal—otherwise, the U.S. could descend into truly desperate conditions within months without Chinese imports. Full coverage here:Interview Transcript Text

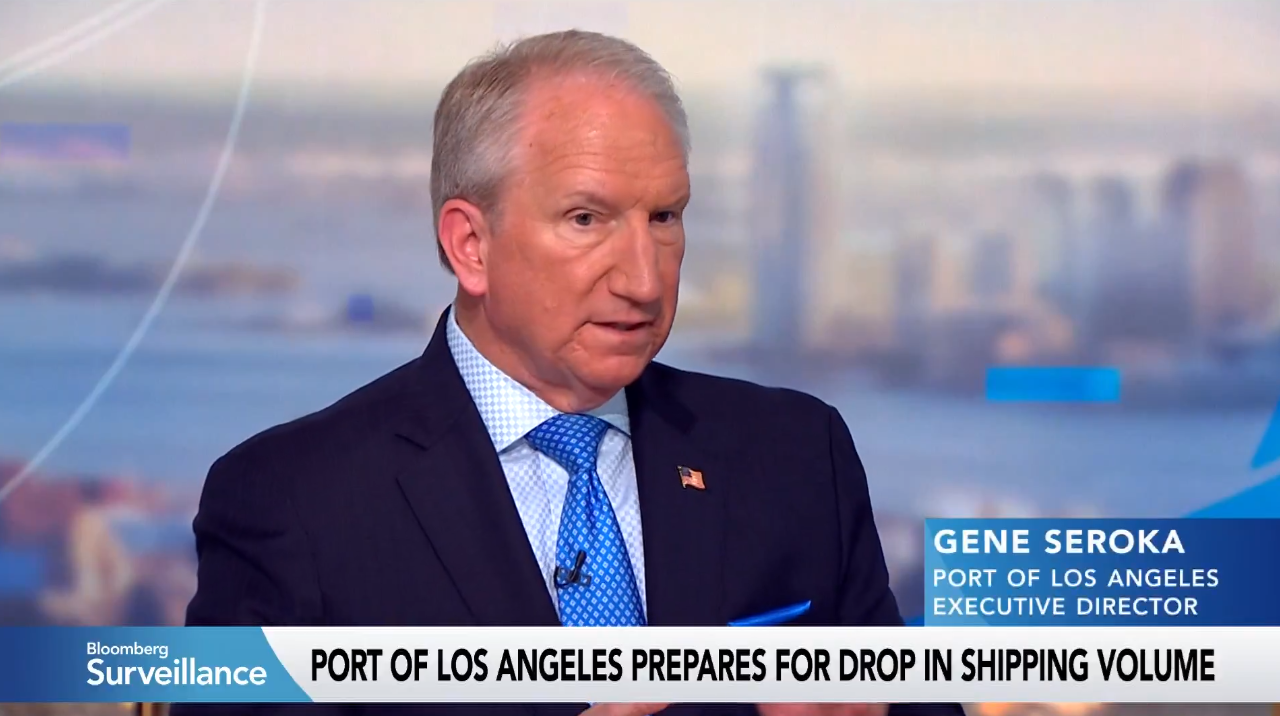

Bloomberg: Just describe for us, let's take a beat, really frame it for us, how much volume has just dropped off in the last few weeks? Gene: Yeah, about a third of the import volume, which means, give or take, about 50,000 20-foot equivalent units gone off the arrivals coming in next week. Bloomberg: From next week is when you expect to see this really hit. Gene: That's correct, and that matches up. The announcement's back on April 2nd. Then on April 8th, a little bit of a change on everybody, ex-China, Mexico, Canada. And those arrivals are coming at us this weekend. Bloomberg: We'll, of course, dedicate time to your poor. But I'm just wondering how you're anticipating this rolls and ripples through the economy from here, how it hits trucking, when this turns up on the shelf. What's the distance, the time from when you see a drop off in volume and when we as consumers see the shortages? Right. Gene: So CEOs are telling me, hit the pause button, right? I'm not going to import any more at these kind of prices. Let's wait and see. I don't know if it's going to be two hours, two days or two weeks until I get some clarity. Then hiring off the table for right now. Capital investment, pause. And the retailers are telling me that realistically, even the 10%, I'm going to have to pass it on to the consumers. Bloomberg: So how much is this really coming from all over? It's not just about China. This is about really global trade coming to a standstill until there is a much greater degree of certainty and a much lower tariff rate than even the baseline that's been put out there. Gene: Yeah, when I was last with you all, Lisa, I said global trade's going to slow, economies will follow, and that's exactly what we're seeing. Back in November, so many of us were wringing our hands about 4% inflation. We've just added 10 percentage points of imports coming out of Southeast Asia for our port, and these unbelievable numbers out of China. Bloomberg: How much are you going to see a real decline in dock workers if this goes on? Yeah, this is the question. Gene: So the trucker hauling four or five containers today, next week, she probably hauls two or three. The dock workers are no longer going to see overtime and double shifts. They're going to probably work less than a traditional work week, starting right off the bat. Every four containers mean a job. So when we start dialing this back, it's less job opportunities. Bloomberg: And what happens if we get a deal? Gene: If we get a deal, it's going to take about a month. Let me walk you through that real quick. About two weeks to get the ships repositioned around these major ports, from Qingdao to Shanghai to Xiamen, load up all those containers, and then another two weeks to steam across the Pacific to get to us. This is important because now we're talking about spring and summer fashion. So we're kind of at a crux here that we've got to have something pretty quick. Bloomberg: And back to school, which is, I think, very critical when it comes to political pushback for this administration. We have a story out, it was anecdotal reporting as well, we've heard about China quietly starting to exempt about a quarter of U.S. imports. Are any U.S. importers exempting Chinese tariffs? Is there a way to get around the 145 percent? Gene: Not really. There may be some exceptions, Anne-Marie, maybe a little bit going north or south of us. But realistically speaking, nobody is out there talking a lot about, hey, I got a better deal coming out of China right now. Bloomberg: The Flexport CEO joined us earlier in the week, and he said ocean fright is down 60 percent from China. When do we see 100 percent? Gene: Good question. It depends on how long this goes. We heard the reports overnight through Bloomberg that the folks in China are thinking about talking. What does that mean? Okay, great, but we've got to get a move on here. The other thing is that retailers are saying we've got about five to seven weeks of normal inventory in the country right now. Then we start to see spot shortages if it goes on much beyond this. ### Follow my podcasts, interviews, articles and social media posts on: Twitter: https://twitter.com/HealthRanger Brighteon.social: Brighteon.social/@HealthRanger Brighteon.io: Brighteon.io/healthranger Telegram: t.me/RealHealthRanger Brighteon.com: Brighteon.com/channels/HRreport Rumble: Rumble.com/c/HealthRangerReport Substack: HealthRanger.substack.com Banned.video: Banned.video/channel/mike-adams Bastyon: https://bastyon.com/healthranger Gettr: GETTR.com/user/healthranger BitChute: Bitchute.com/channel/9EB8glubb0Ns/ Clouthub: app.clouthub.com/#/users/u/naturalnews/posts Truth Social: (I was BANNED by Truth Social for criticizing Trump's secondary tariffs) My music with MP3 downloads and music videos: music.Brighteon.com Join the free NaturalNews.com email newsletter to stay alerted about breaking news each day. Download my current audio books -- including Ghost World, Survival Nutrition, The Global Reset Survival Guide and The Contagious Mind -- at: https://Audiobooks.NaturalNews.com/ Download my popular audio book, "Resilient Prepping" at ResilientPrepping.com - it teaches you how to survive the total collapse of civilization and the loss of both the power grid and combustion engines.Trump declares EU ‘nastier than China’ as trade war escalates – Is the bloc fighting for survival?

By Lance D Johnson // Share

Trump’s tariff retreat sparks fears of accelerating BRICS dominance

By Finn Heartley // Share

A gilded gift sparks controversy in the skies: Trump’s Qatar jet deal upends tradition

By Willow Tohi // Share

Trump eyes $1 trillion Saudi investments as Gaza war stalls Israel deal

By Cassie B. // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share