Parler

Parler Gab

Gab

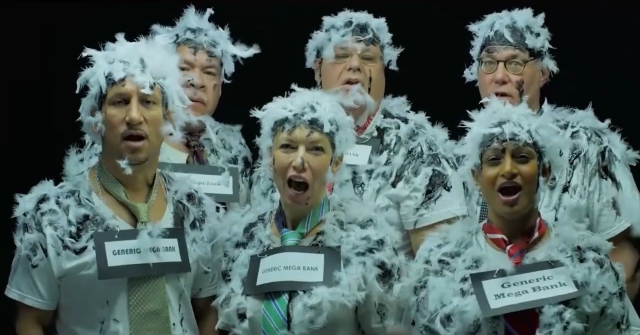

She also said that a source from inside the bank informed her that the management were like something out of the TV show The Office.Is it surprising that Signature Bank failed?

Their executive team spent millions of dollars to produce music videos & TV shows about themselves Try not to cringe as you watch this: pic.twitter.com/16K70FQq5o — Genevieve Roch-Decter, CFA (@GRDecter) March 13, 2023

"Yesterday, Signature Bank became the 3rd-largest bank failure in US history," she noted on March 13. "Signature had $88 billion in deposits and $110 billion in assets at the end of 2022. 89.7% of deposits were not FDIC insured."The execs also tried their hands at a comedy sketch/musical combo.

I'm speechless. pic.twitter.com/y3lWDCcSlp — Genevieve Roch-Decter, CFA (@GRDecter) March 13, 2023

"Who would have trusted their money to these guys after watching this video? This is a circus not a bank," Roch-Decter continued as she posted yet another ridiculous video.Yesterday, Signature Bank became the 3rd-largest bank failure in US history

Signature had $88 billion in deposits and $110 billion in assets at the end of 2022. 89.7% of deposits were not FDIC insured. — Genevieve Roch-Decter, CFA (@GRDecter) March 13, 2023

"This is the same bank that closed President Trump’s accounts two years ago, reasoning that it would not do business with Trump after the January 6th 'rioting and insurrection' and calling for him to resign," Summit News pointed out. The collapse of Silicon Valley Bank (SVB) is just one instance of a looming financial crisis in the banking sector, with potential losses exceeding $620 billion. The Federal Deposit Insurance Corporation (FDIC) reports that the banking industry is facing unrealized losses of more than half a trillion dollars, which will have to be addressed eventually. But of course, it's uncertain when this will happen. The Federal Reserve, the FDIC, and the Treasury Department are actively working to prevent a financial contagion event by patching up any leaks in the banking sector. However, there is still concern about the looming potential losses that will be catastrophic for the global economy. According to 'experts,' the root of this problem lies in the significant amount of bonds and treasuries that banks acquired during periods of low-interest rates. Now, as Jerome Powell raises interest rates in an attempt to combat inflation, these bonds and treasuries have become severely devalued. “This is because higher interest rates mean that new bonds accrue higher rates of returns for investors,” writes Ryan King for The Washington Examiner. “As a result, older bonds have comparatively lower rates of return, rendering them less desirable for investors and therefore triggering a plunge in the value of older assets.” “A consequence of the $620 billion unrealized potential loss phenomenon is that banks may quickly find themselves with less cash on hand than their books might have suggested.” The current financial conundrum seems to have no solution, making a crash and collapse inevitable. It's only a matter of time before this financial Armageddon takes shape in a way that can no longer be denied. Sources include: Summit.news NaturalNews.comWho would have trusted their money to these guys after watching this video?

This is a circus not a bank. pic.twitter.com/UYXxyifD4b — Genevieve Roch-Decter, CFA (@GRDecter) March 13, 2023

UBS $3.2B takeover of Credit Suisse wipes out AT1 bonds, irks bondholders

By Belle Carter // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share